SQM - at cyclically low prices, poised for high future returns.

One of the world's largest lithium producers, SQM is poised to benefit from the growing demand for power across EVs, energy transition, and AI datacenters.

Executive Summary

In this report, we provide an in-depth analysis of Sociedad Química y Minera de Chile (“SQM”), a prominent player in the global lithium market and a leading producer of fertilizer products and iodine. SQM's strategic assets, including the lithium-rich Salar de Atacama and the nitrate and iodine-rich El Norte Grande, uniquely position the company to capitalize on the booming electric vehicle and renewable energy sectors. After experiencing an extraordinary increase in its stock price during the lithium market frenzy, SQM has faced recent headwinds from oversupply and declining lithium prices. However, we believe that the long-term demand for lithium remains robust due to the structural shift toward clean energy and advancements in battery technology. Our analysis suggests that as supply growth moderates and consumption continues to rise, SQM's stock is poised for recovery, making it an attractive investment opportunity in a fast-evolving market.

Business Overview

SQM is a Chilean-based chemicals (and mining) company that produces three key products: 1) Lithium, 2) Specialty Plant Nutrients (i.e., fertilizer products), and 3) Iodine. SQM is a global leader in these categories, thanks to its two flagship assets that allow it to extract the ingredients at low costs. The two flagship assets are 1) Salar de Atacama, a brine resource rich in lithium and potassium, and 2) El Norte Grande, an arid, mountainous rock (e.g., caliche ores) that contains high concentrations of nitrates and iodine. These are unique assets that its location—high elevation and intensely arid environment—allowed it to form over thousands of years.

At Salar de Atacama, the brine is pumped up from underground reservoirs to the surface. Then, through a series of evaporation ponds and processing plants, potassium is removed from the pond. Lastly, natural sun evaporation leaves concentrated lithium, which is further processed to produce lithium carbonate (“LCE”). It takes about 12-18 months from pumping to evaporation to final product. At El Norte Grande, iodine and nitrates are extracted through traditional mining methods, primarily involving ore extraction, heap leaching, oxidation, and refining. These products are sold globally.

The Setup

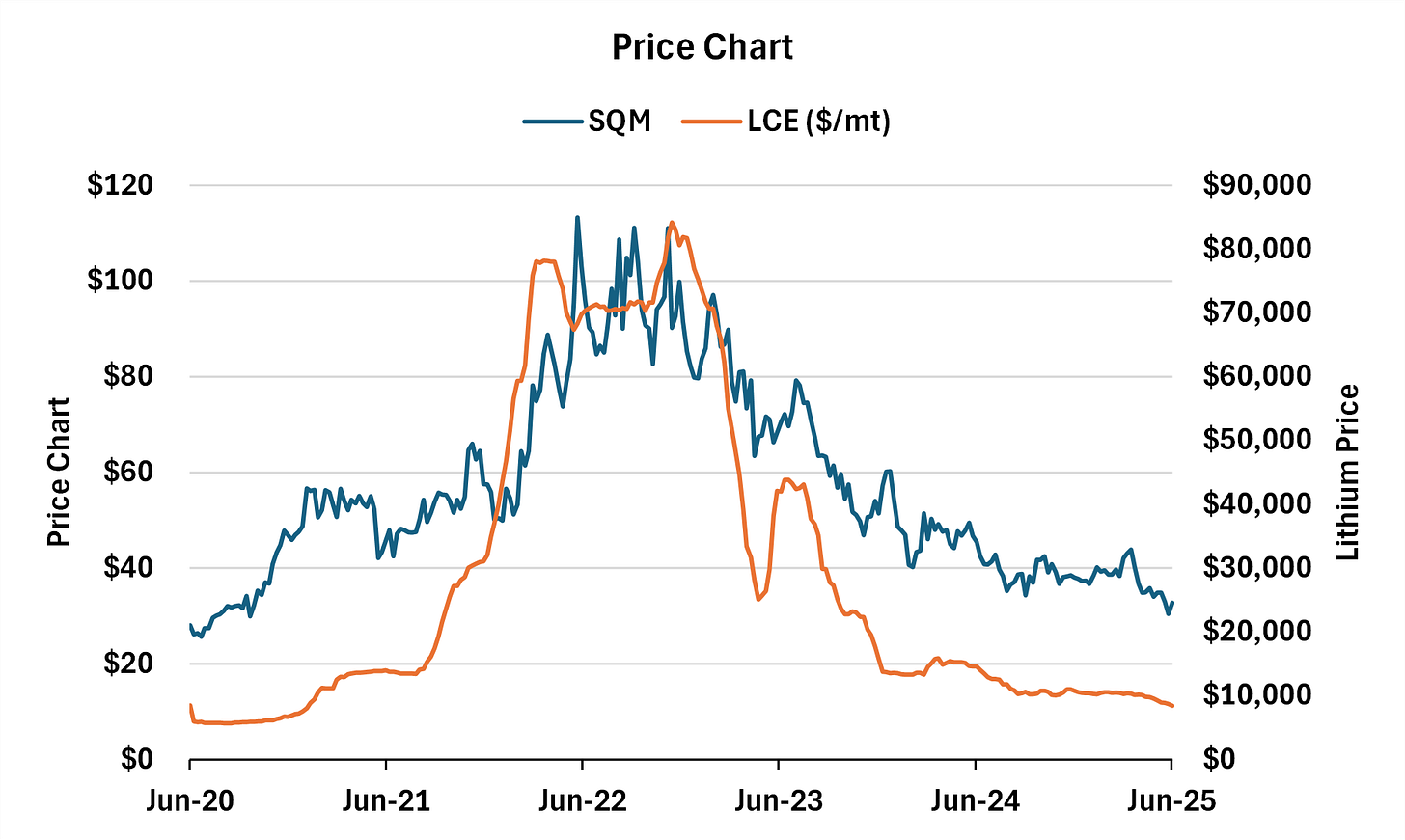

During the lithium frenzy four years ago, the LCE price increased from about $5k/t to over $80k/t, and with it, SQM’s share price rose from $30 to over $100. Lithium is a crucial material in all batteries. As the demand for electric vehicles (“EVs”) and renewable energy storage (“ESS”) accelerated, auto manufacturers (“OEMs”) and battery manufacturers raced to secure supply, driving up prices. Since then, a moderation of EV demand and a significant increase in lithium production by SQM and others have led to an oversupply of lithium, resulting in its price collapse. The price peaked in 2Q24 and has since declined by nearly 90%. Over the last twelve months, LCE has been trading between $8k/t and $12k/t and is down another 20% YTD.

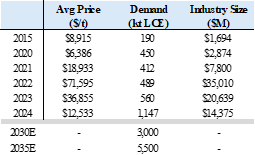

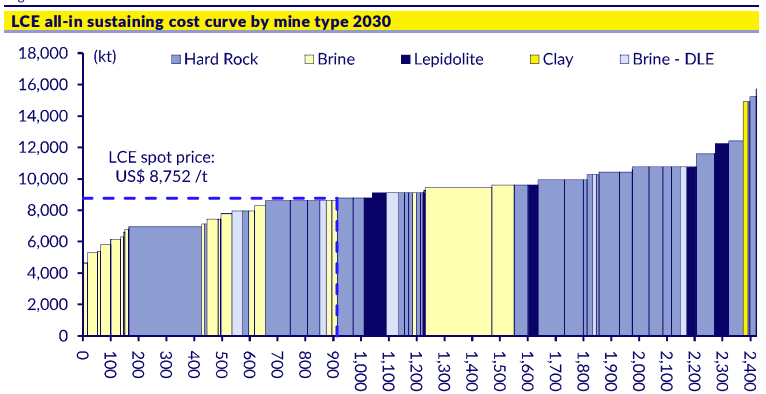

Looking at the cost curve, the current price of $8k/t is below cash costs for many producers and is unsustainable. Due to astronomically high prices for a few years, the producers were flush with cash and could withstand the drawdown. As cash levels deplete through capacity additions and operating cash losses, prices will need to increase to meet the world’s incessant demand for lithium or supply will need to be cut (which will eventually lead to higher prices). It’s worth noting that LCE’s price collapse over the last several years is more due to an oversupply of LCE than a demand issue. Over the past two years, global consumption has increased from under 500kt to over 1,000kt and is expected to reach nearly 1,500kt this year. In other words, supply additions were faster than demand growth, but as supply additions slow and demand catches up, prices are likely to increase.

Before going into the thesis, a brief history of lithium may be helpful. Before its use in EVs, lithium was a niche market. In 2010, the largest applications of lithium were for ceramics and glass, as well as batteries in electronic devices, which accounted for 31% and 23% of demand, respectively. By 2015, batteries for EVs made up 40% of total demand (3/4th in electronic devices and 1/4th EVs), and the world was consuming about 190kt with a market size of just $1.7B. Then, in 2024, EVs and ESS accounted for nearly 90% of annual demand, and the market size increased to over 1Mt (1,000kt) and $14B. As the world continues to transition to clean energy and electrification, the demand for lithium is expected to increase to 3Mt by 2030 and 5.5Mt by 2035 (17% CAGR).

Thesis

The ultimate bet here is on a potential recovery in lithium prices. We hold this belief for several compelling reasons, which we will outline in the following sections. This optimism is rooted in our analysis of the market dynamics and the future of clean energy and EVs.

1. We view the shift towards clean energy and EVs as structural.

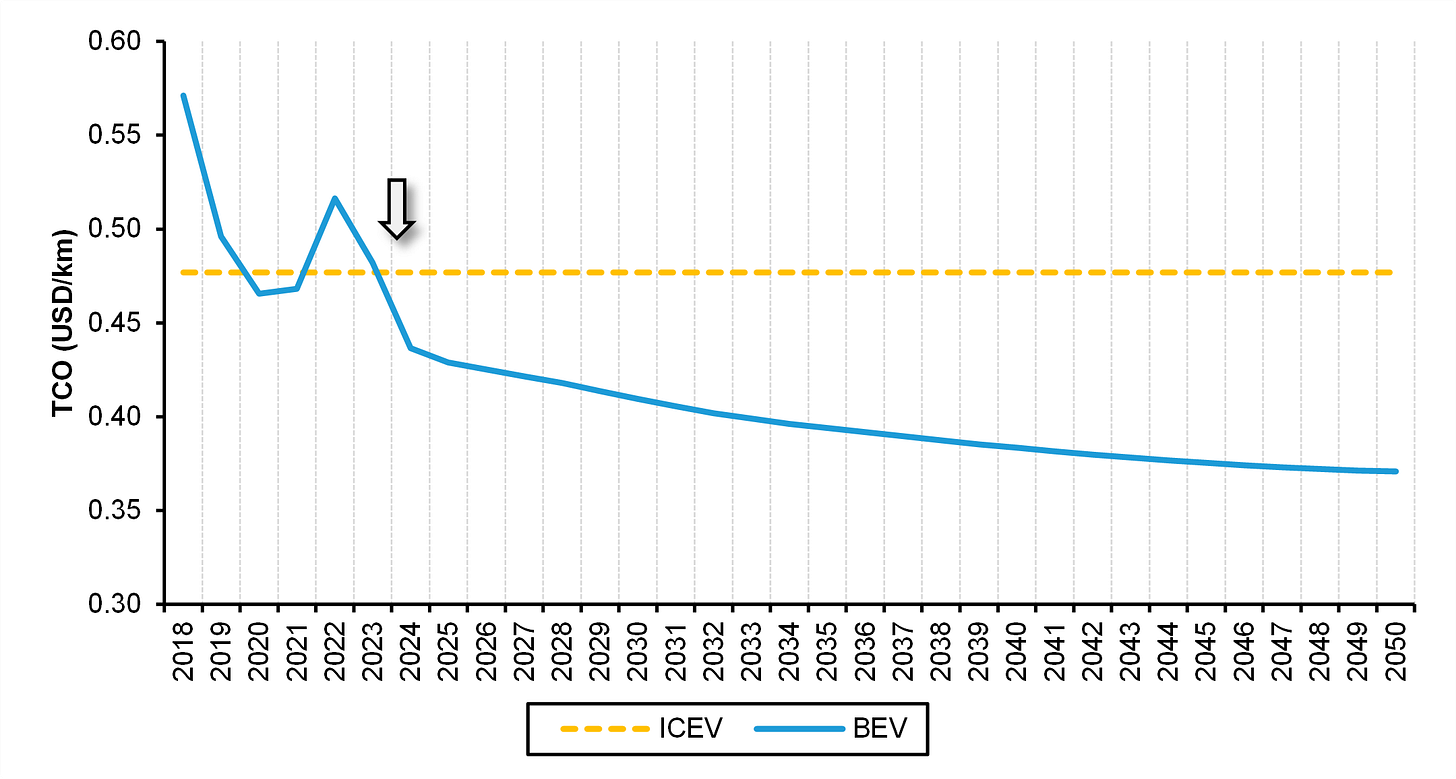

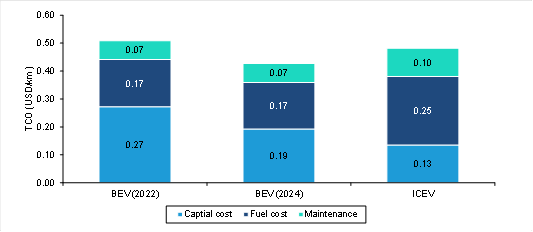

We believe the long-term demand for lithium will remain robust. There is a policy tailwind from governments around the world to decarbonize, but more importantly, renewable energy is becoming the better economic decision thanks to the continued improvement in battery technology and the precipitous decline in battery costs. Additionally, EVs are also close to reaching cost parity with internal combustion engine (“ICE”) vehicles while providing a superior driving experience.

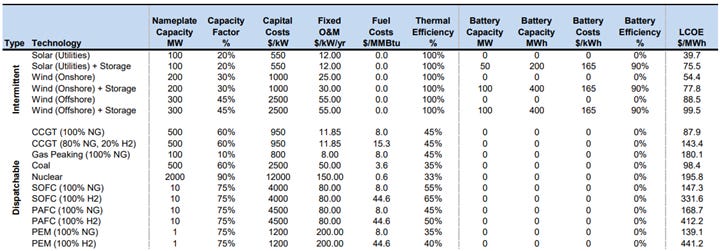

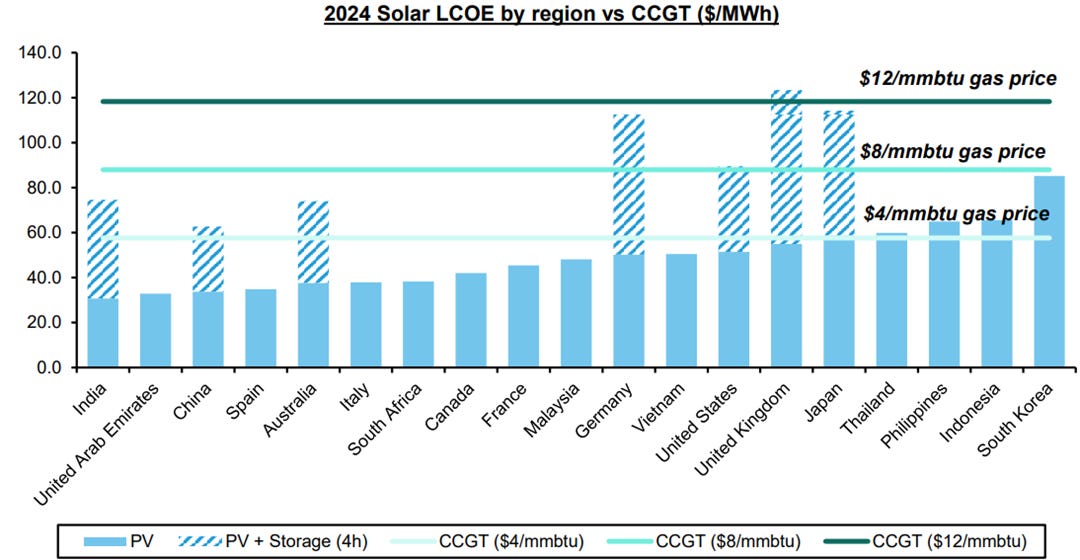

On the utilities side, the levelized cost of electricity (“LCOE”) of wind and solar has become competitive versus traditional base load powers even without government subsidies. LCOE measures the total cost of power production over its life, including capital investments, operating costs, and fuel costs. The LCOE can vary significantly from country to country and also from city to city within a country, but broadly, LCOE for wind and solar has become as cheap as traditional thermal power. Another advantage wind and solar have is that they can be built much faster (e.g., 2-4 years vs. 8-10 years). Permitting and regulation timelines are much stricter for thermal generation, and reports suggest that the backlog for turbines needed in thermal power is years long. With the advancement of AI and the race to secure energy for the industry, we think solar and wind will be viewed as necessities. Although there are some near-term risks with the “Big Beautiful Bill”, a proposed legislation that could potentially cut subsidies for the industry, we anticipate that the US government will make a policy pivot at some point (if not within this bill) as the need for more power will outweigh the incorrect belief that solar and wind are uneconomical. Energy storage systems (“ESS”) batteries are required with intermittent generation to stabilize the grid as more wind and solar generation is introduced, which is bullish for the continued long-term demand for lithium.

For EVs, range anxiety and high costs are frequently cited as the most significant impediments for consumers. However, these concerns are starting to subside quickly. Battery technology improvement has rapidly increased the battery density (and size) in a vehicle, increasing from <200Wh/kg ten years ago to >300Wh/kg, and reduced costs (from >$1,000/kWh to <$100/kWh). This increased the range on one charge from <100 miles to 300+ miles and decreased the costs of EVs. There have been many technology milestones over the last ten years. The evolution of the battery’s cathode chemistry and pack designs has helped improve density (e.g., higher nickel-mixture chemistries and cell-to-pack designs), and there are more improvements in the roadmap (e.g., different materials for the anode and electrolyte). Details on how the roadmap will further improve energy density are outside the scope of this report, but the conclusion is that range anxiety is unlikely to be a concern in the future and costs should continue to decrease as the EV supply chain for components matures further. Once these two are no longer impediments, we believe EVs will become the preferred consumer product. The modern EVs in China are equipped with a suite of intelligent software and are now starting to be referred to as EIVs (electric intelligent vehicles) as they integrate not only autonomous driving but also personalized AI assistants, smart connectivity, and other digital services. While some of these technologies can also be equipped in traditional ICE vehicles, the trend towards electrification and the relative ease of connecting electrical power batteries with software equipment have made these features predominantly available on EVs. Better mileage on a single charge, lower total cost of ownership, and a superior driving experience culminate in our view that EVs will be the standard model of the future. This also supports our view of strong long-term demand for lithium.

2. Greenfield projects require higher prices to incentivize production.

SQM, the world’s largest producer of lithium, currently produces ~200kt of LCE and is targeting to grow production to 250kt by 2030. Including SQM, other large producers such as Albemarle, Ganfeng, Tianqi, Mineral Resources, Arcadium (now part of Rio Tinto), and Pilbara collectively produce around 750kt, which is slightly more than 50% of global production. The planned expansion by these producers through 2030 amounts to ~500kt, which is well short of the required additional supply of around 1.8Mt (a 3Mt projection, compared to 1.2Mt today), so some of the incremental supply will have to come from new projects. The greenfield projects in Africa, the Americas, China, and Australia all need much higher prices than today’s $8k/t to earn a return on their investment. We estimate that the incentive prices for these projects range from $15k/t to $25k/t. In particular, the brine resources in South America have relatively high upfront capital costs because chemical processing plants are usually built onsite. Lithium from hard rocks, also known as spodumene, also needs refining to convert spodumene to LCE (or lithium hydroxide, which equates to LCE in this thesis). The vast majority of spodumene from Australia today is shipped to China for final conversion, where LCE/LiOH is sold to battery manufacturers, who are also predominantly in China. When shipping and conversion costs are added, the spodumene producers also need $15k-$20k/t. We often see this in mining, where spot prices fall below the marginal cost of producers’ cash costs, but prices then return to the metal’s marginal cost, allowing miners to supply the needed metal to the world.

3. SQM can withstand lower prices longer given its diversified cash flow streams.

While SQM awaits a recovery in lithium prices, it continues to generate strong cash flows from other segments, notably Specialty Plant Nutrients (“SPN”) and Iodine. As previously mentioned, SQM is also an industry leader in these markets, boasting a commanding 40% and 35% market share, respectively. Historically, SPN has been a high-margin business with steady volume growth of 4-5% per year with moderate volatility in pricing. Before lithium became an important mineral, SQM was actually more widely known for its fertilizer products, as this segment contributed approximately 30% of the company's profits. Since the start of the Russia-Ukraine War, however, the SPN segment has experienced abnormally high volatility. Fertilizer prices went parabolic due to limited supply from Ukraine, which impacted SQM’s volume as farmers forgo fertilizer usage. Full-year 2024 and 1Q25 prints suggest that post-war volatility may be subsiding; prices have normalized, and volume is starting to recover. We feel confident in this segment’s ability to achieve pre-war profitability as SQM’s naturally produced and premium-priced products are critical for crop production.

Iodine is a niche market with approximately $3 billion in global sales in 2024. The demand for iodine has been steady, and prices recently reached all-time highs due to constrained supply. Nearly 90% of production comes from five companies in Chile and eight in Japan (~60% Chile, including SQM), so a minor disruption to one company can meaningfully affect market imbalance. Despite all-time high prices, the demand for iodine remains strong. The primary demand comes from X-ray contrast media (“ICM”), an important material that allows for clearer visualization of the inside of the body. This demand has proven to be rather inelastic, given iodine is a low-cost item in the total cost of an X-ray. With SQM investing in capacity additions and other producers returning to normalized production, we anticipate that iodine prices will moderate though we do forecast iodine to remain a meaningful cash flow contributor over the medium term. In 2024, the profit contribution from lithium, SPN, and iodine was 43%, 13%, and 39%. Using our 2030E lithium price of $14k/t, we anticipate the profit mix to be roughly 60%, 20%, and 20%.

This diversified cash flow stream from uncorrelated markets provides SQM downside protection. SQM can ride the drawdown in lithium, thus commanding a premium multiple compared to its lithium peers.

Risks

We identified two key risks to our thesis. They are 1) the near-term deceleration of EV demand due to oversupply in China and 2) improvements in extraction and refining that meaningfully increase production without requiring greenfield projects.

1) There has undoubtedly been a surge in EV demand in China. With nearly 80% of total lithium demand coming from EVs and half of that coming from China, Chinese EVs have been a meaningful consumer of lithium. To put this into context, over the last five years, it has been reported that the number of OEMs in China increased from ~10 to ~30. Part of this reason is that it’s much easier to build an EV than a traditional ICE vehicle due to the far fewer components required (e.g., ~20 vs. ~2000). An EV has just an electric motor, a battery pack, and a controller, whereas an ICE vehicle has thousands of parts to bind the engine, transmission, and gear systems. This has drawn in more competition to the industry, even tech companies like Alibaba (as a JV) and Xiaomi entering the race. In the last several quarters, the Chinese EV companies have been engaged in price wars. An oversupply of EVs is forcing many to desperately sell cars at lower prices. This will likely lead to bankruptcies, restructurings, and consolidation, which is necessary for the long-term health of the industry. During this transition period, demand may slow, which will also impact the demand for lithium.

One mitigant to this temporary slowdown could be the demand from ESS. In fact, the demand for batteries in ESS, as measured by GWh, is expected to grow faster than that of EVs. In 2024, global battery shipments were approximately 1,000 GWh for EVs and 300 GWh for ESS. By 2030, EVs could reach 3,500 GWh (25% CAGR), and ESS can reach 1,400 GWh (30% CAGR), according to CATL, a battery manufacturer. Another demand comes from AI data centers, which also need backup battery packs. Therefore, even if the Chinese EV market experiences a period of temporarily suppressed demand, lithium demand could be sustained through non-EV markets.

2) Lithium is a relatively new industry compared to other exploration and production industries, such as gold, copper, or oil. These industries have been in existence for a long time and have undergone significant improvements in exploration, extraction, and processing technologies over the past century, resulting in lower costs and increased production. The same improvements could be on the way for lithium. For example, SQM’s Salar de Atacama, one of the world's highest-grade lithium assets, currently recovers approximately 50% of the available lithium. A recovery improvement to 70% could imply a massive 50% increase in annual production. One technology that the industry is attempting to utilize is direct lithium extraction (“DLE”), a process that enables the direct removal of lithium ions from brines through a chemical reaction. In theory, DLE at Salar de Atacama could reduce production time from 12-18 months to just days, implying a massive increase in production. It’s a technology that is currently being utilized in some brines in Argentina, but because every brine has different impurities, each chemical reaction requires high customization, and deploying at scale is difficult at this point. French mining company Eramet found this out the hard way. After starting commercial DLE production in Argentina, it is facing delays due to technical issues. Furthermore, even if commercial production is established, we think it’s unlikely that SQM will shut down its existing operations to reorient the entire production line. Instead, it’s more likely that this is deployed to contingent, new brines being developed in the future.

Whether it’s DLE or some other technology, we do believe lithium production will become more efficient in the future. All else being equal, lower production costs should lead to a decline in prices, but we think this will lead more lithium demand. Some parallels we can draw are to the semiconductor industry and the agriculture industry. The doubling of transistor capacity (i.e., Moore’s Law) and the production of synthetic ammonia drastically lowered the costs of chips and fertilizers, leading to exponential growth in demand. Because batteries and electricity are such crucial parts of our lives, we can envision a scenario in which lithium demand follows a similar path to that of chips if there are leap-bound improvements in production. All things considered, we remain bullish on long-term lithium demand.

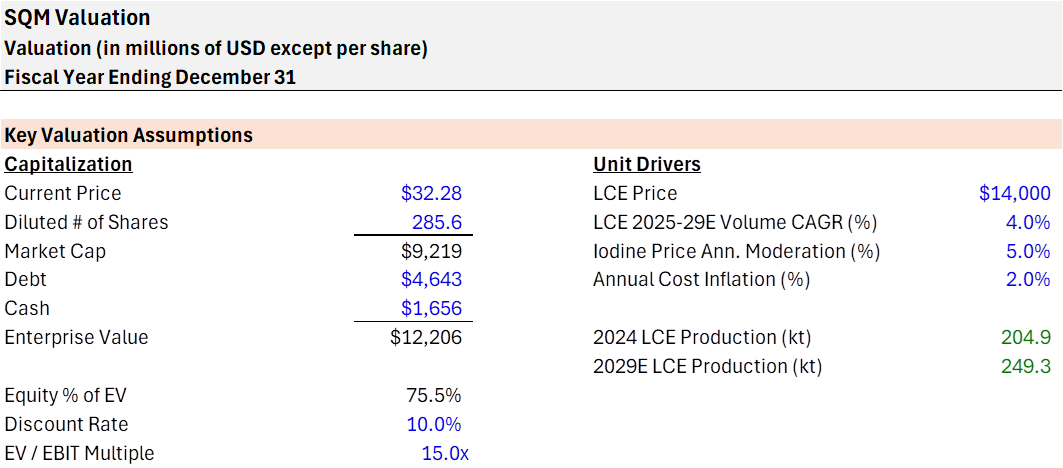

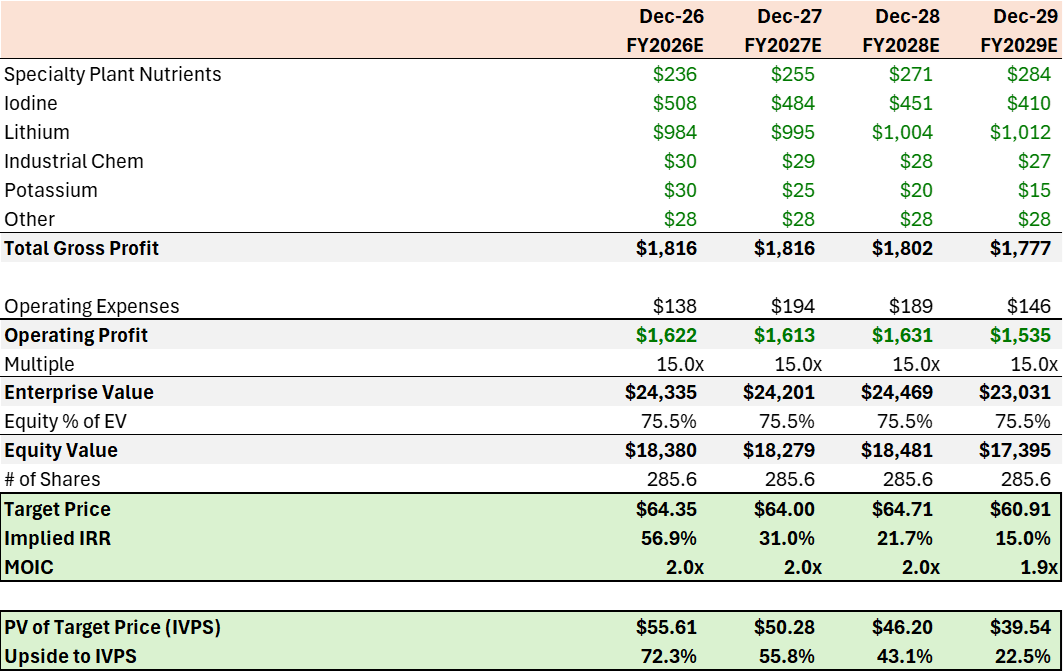

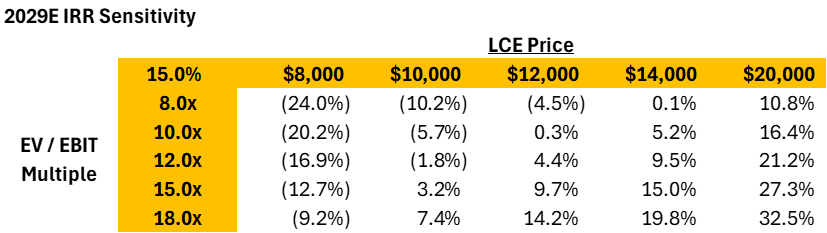

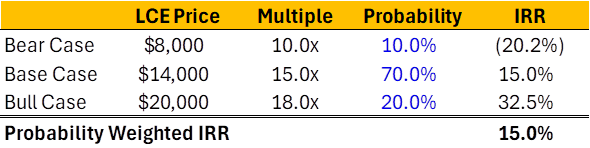

Valuation & Potential Returns

· LCE price of $14k/t stems from our view on continued lithium demand and the need for higher prices for producers to supply the metal.

· We use mid-cycle 15x EV/EBIT multiple on 2029E.

· We assume SQM will stay capital structure neutral through 2029, hence the use of 75.5% equity % of EV.

Why does this opportunity exist?

This is a simple yet classic case of a catalyst being too far away. The market is ignoring the stock until there is a clearer signal that the lithium is recovering. For us, the IRR on the stock is still attractive even if the price recovery happens in 2029. We also think the lithium price could easily overshoot on the way up, closer to $20k, which would lead to multiples expanding even more (e.g., the bull case above).